CASE STUDY

Tax Allocation – An Investment Strategy

Most individuals use the same investment strategy (pro-rata), ignoring how the accounts are taxed.

Problem

Minimize taxes and maximize wealth

Solution

Match investment types with each account type for the highest tax efficiency.

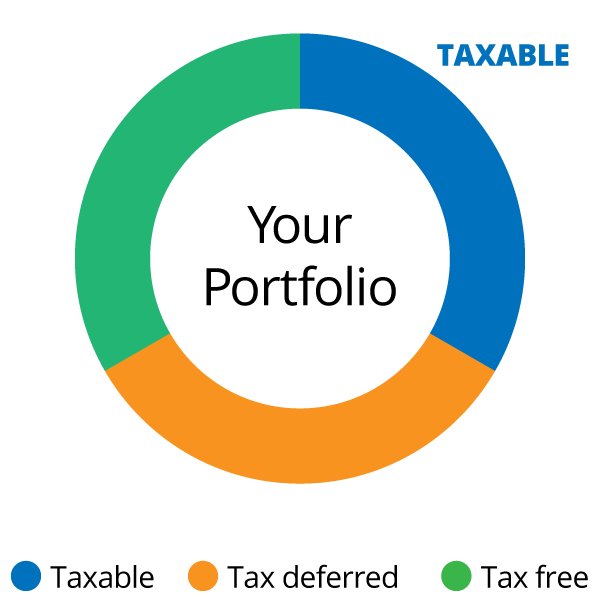

- Taxed – Annually

- Inv. – Value Equities

- Strategy – Lower capital gains tax rate as well as potentially eliminate the tax with tax loss harvesting.

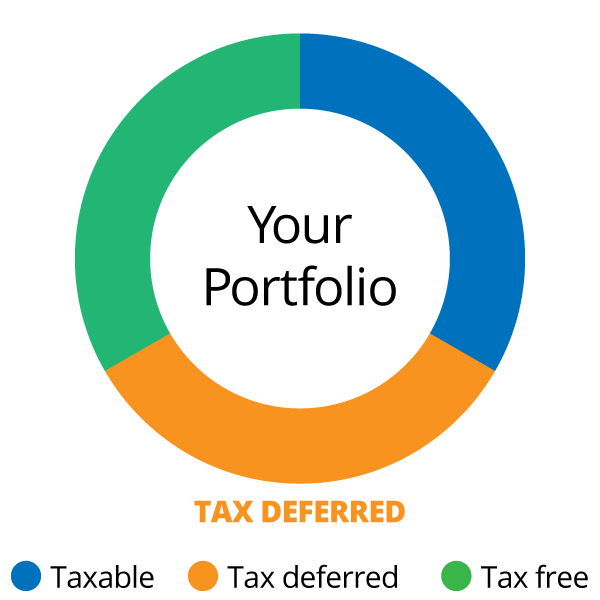

- Taxed – On withdrawal at the ordinary tax rate.

- Inv. – Taxable Bonds

- Strategy – interest on bonds is taxable at ordinary rates. Rates are the same and it allows you to postpone the tax.

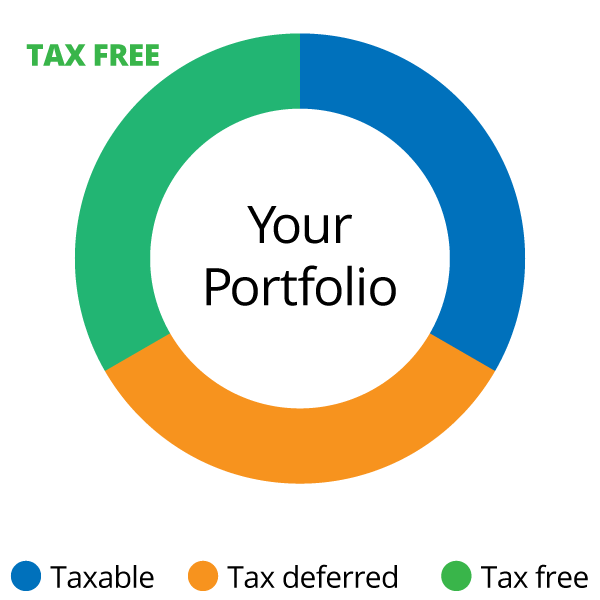

- Taxed – TaxFree.

- Inv. – Growth Equities

- Strategy – Over time these investments historically have had the highest gains. Match with a tax-free account and eliminate the tax.

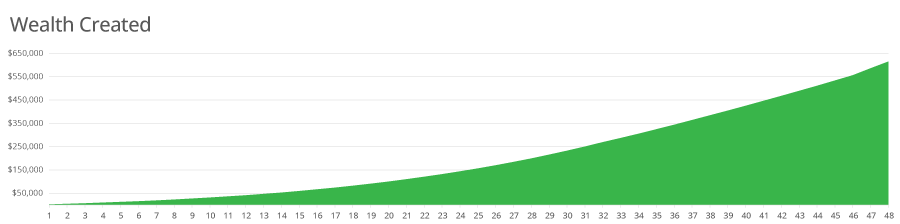

Benefit

Implementing this strategy of minimizing taxes can create wealth over time. It is not what you earn but what you keep that makes a difference!