CASE STUDY

Concentrated Position with Unrealized Capital Gains

A portfolio that is too heavy in just one security poses a substantial downside risk. This is often defined as “putting all your eggs in one basket.” A concentrated position is identified as an individual stock that exceeds a certain percentage of the entire portfolio.

Problem

The client is not diversified and has a large % of their investable assets in one stock. The cost to diversify is $18,564!

Solution

Diversifying into a Tax-Efficient Direct Indexing Strategy over a 3-year period.

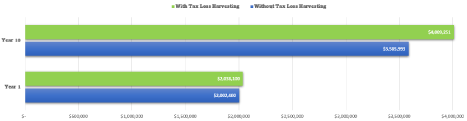

Tax Loss Harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains with those losses. The end result is that less of your money goes to taxes and more may stay invested, working for you.